Free yourself from the monotonous burden and time spent worrying over your taxes and focus on what you were put on this earth to do!

Built for freelancers, by freelancers who know your pain.

TAXOD is the antithesis of accounting. Its simple, beautiful, intuitive and dare we say, enjoyable. It offers you powerful tools in a simple, easy-to-use interface which gives the same experience whichever device you use it on.

TAXOD uses the latest Open Banking technology to enable you to connect directly to your UK bank and get a live feed of all your comings and goings. Meaning, youll never miss another business transaction again. And because your transactions are automated and categorised for you, it means youll always be up to date and in control with little effort.

Still have last year’s tax return to do? Of course you do (we all do!) With BankSync you can do an entire year worth of bookkeeping in minutes! Combined with our simple in-app tax return filing (which is the simplest way to file your tax return on the planet, btw), you can do all of your accounting/bookkeeping and file your tax return, in under 20 minutes.

Bye bye, January blues.

Even if your self-employed and employed, TAXOD takes PAYE earnings into account and give you your best tax owed figure through the year.

Now thats boring stuff taken care of, your free to do just about anything else.

Download TAXOD and use FREE on ZERO, today.

- UK self-employed / freelancers / sole-traders

- Earnings less than £85,000 (VAT threshold)

Filing support for (2018/19) from April 6th, 2019:

Main Tax Return (SA100)

Self-employment (SA103s)

Employment (SA102)

Underpaid tax PAYE (SA110)

PAYE employment (alongside freelance work)

Also includes:

Marriage allowance

Charitable giving

Capital allowance (vehicle only)

Payment on account

Blind person’s allowance

TAXOD currently **do not support** the following for the current tax year (2018/19).

- Multiple businesses

- VAT registered

- UK property

- Foreign income

- Capital gains summary

- Trust income

- Residence, remittance basis etc

- BankSync. Automated bookkeeping and categorisation

- Save time with recurring expenses (manual entry)

- Automatic paper receipt digitising

- Maximise working from home tax relief

- Seamless recording across multiple tax years

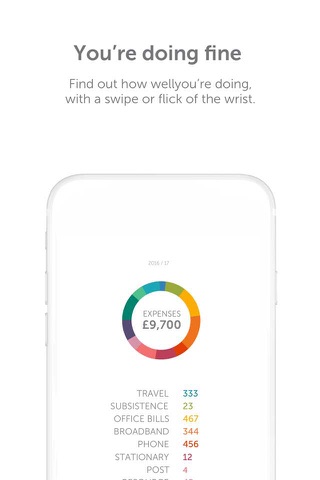

- Your Tax Owed calculated on the fly

- Export professional financial reports: tax summary & profit or loss

- Export data as PDF

- See breakdown’s of your incomings and outgoings

- See your whole financial year at a glance (flip the phone horizontally)

- Never miss a tax return filing deadline, again

- In-app tax return filing directly to HMRC

- HMRC recognised tax filing engine

- Auto-reconciliation

- 100% calculation accuracy

- Up to 92% auto-completion of your tax return

- File returns from previous tax years

- Simple amend and resend your tax return through TAXOD

To learn how TAXO’D protects your privacy and to see our terms of service, visit: [https://www.taxod.com/terms](https://www.taxod.com/terms)

*Subscription Information

Power-up with our HERO subscription, only £69 per annum.

Power-ups gained:

- BankSync

- Tax return filing

- Export reports and data

• Payment will be charged to iTunes Account at confirmation of purchase.

• Your Subscription automatically renews at £69unless auto-renew is turned off at least 24-hours before the end of the current period.

• Hero subscription auto-renews at £69 unless auto-renew is turned off 24 hours prior to the end of the subscription period.

• You can manage your subscription and turn off auto-renewal by going to your iTunes account settings after purchase. On your device, go to Settings > iTunes & App Store, tap your Apple ID, and tap Subscriptions.